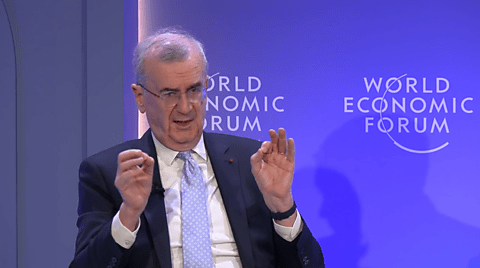

At the World Economic Forum, Banque de France Governor François Villeroy de Galhau proclaimed that he trusts “central banks with a democratic mandate” far more than the “private issuers of Bitcoin.” The problem? Bitcoin doesn’t have issuers. Coinbase CEO Brian Armstrong, another speaker at the event, quickly corrected him, saying, “Bitcoin is a decentralized protocol. There’s actually no issuer of it. … There’s no country or company or individual who controls it in the world.”

Yet, this exchange got me digging. As it turns out, it wasn’t the only time that the head of France’s central bank has been wrong about money.

#1 The US Free Banking Experience Does Not Show That Private Money Fails

Still at the World Economic Forum, Villeroy de Galhau tried to appeal to history by pointing to the experience of free banking in the United States. He described this era as suffering from “many crises of confidence.” He did so in an attempt to undermine trust in private money, but the only trust undermined here should be that in governments.

What he didn’t say is that banking crises occurred during this period in large part because of the laws and regulations in place that made banks unstable. George Selgin, director emeritus of the Cato Institute’s Center for Monetary and Financial Alternatives, has gone to great lengths to raise awareness about this history. As Selgin’s research shows, laws restricting branching and limiting investments to state bonds prevented banks from diversifying their portfolios. The general public may be forgiven for not knowing the history of central banking, but central bankers have no excuse.

#2 Gold Is Not an Inherently Sovereign Asset

Attempting to appeal to history again, Villeroy de Galhau then said gold was a “sovereign asset” governed by the state. However, this claim is similarly misleading. The use of gold as money predates legal tender laws. Governments did not create gold’s monetary role; they appropriated and formalized an already widely used medium of exchange.

However, Villeroy de Galhau took this opportunity to also say that central bank digital currency (CBDC) is the next evolution of money. If CBDCs are an “evolution” of anything, they reflect the evolution of state control over monetary systems—not a natural progression arising from the market.

#3 The ECB is Not Launching the First CBDC

Turning away from the forum, Villeroy de Galhau also mentioned his support for CBDCs in his “New Year’s address.” Curiously, he said, “For financial and wholesale transactions, 2026 will see the first central bank digital currency (the Pontes project).” Taken as written, this statement is wrong. The first CBDC was arguably created in Finland in 1992. That project died quickly, but CBDCs have seen a resurgence in recent years. China, India, Iran, Jamaica, Kazakhstan, the Marshall Islands, Nigeria, Peru, Russia, the Solomon Islands, Thailand, and The Bahamas have all launched CBDCs in one form or another. There have been even more pilots.

So, at worst, Villeroy de Galhau’s claim is 30 years too late.

Conclusion

All of these statements are just from the first 21 days of 2026. The French central bank governor managed to get it wrong on Bitcoin, US history, gold, and CBDCs. However, to his credit, Villeroy de Galhau made his opinion clear at the beginning of the World Economic Forum when he said, “The first threat is the privatization of money. … Here the answer is CBDC.” At least it’s clear where his reasoning is based.