Today marks the publication of my latest report: Understanding Debanking. The report reviews the growing phenomenon of debanking—the sudden and often unexplained closure of financial accounts.

While media and political narratives often attribute these closures to political or religious discrimination, I found that the majority of debanking cases stem from governmental pressure.

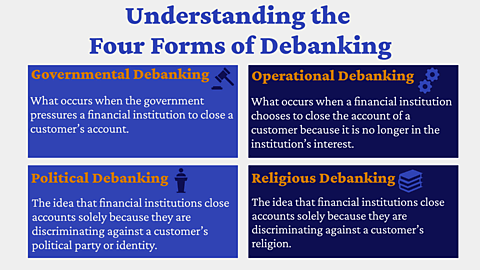

Yet, documenting these experiences is only one piece of the report. Another is recommending a new framework for evaluating these experiences. To do so, I introduced four new categories of debanking: governmental, operational, political, and religious.

Based on public evidence, governmental debanking is the most pressing issue. Those familiar with the fight for financial freedom will likely recall Operation Choke Point. This Department of Justice initiative from the 2010s involved coordinating regulators to choke off businesses from the air they needed to survive: money and access to the banking system. Although it started as a fight against fraud, it quickly began targeting disfavored businesses like payday loan shops.

This same trend has emerged again more recently when the Federal Deposit Insurance Corporation (FDIC) sent confidential letters to banks telling them to shut down their cryptocurrency-related activities.

If Congress is going to put an end to these abuses once and for all, serious reforms are needed. To that end, my report offers targeted reforms (and legislative language) to bring governmental debanking to an end. That means reforming confidentiality laws, reforming the reputational risk regulation, and reforming the Bank Secrecy Act. Doing so would bring debanking out of the dark, remove the tools regulators use to close accounts, and reduce the incentives to debank.

You can find the full report here.