America is facing an unprecedented debt and spending crisis … our current fiscal path is unsustainable and dangerous, jeopardizing our nation’s economic growth, stability and the security of future generations. Congress has a moral and constitutional duty to resolve the crisis, bring spending under control, balance the federal budget, reform and modernize entitlement programs, eliminate fraud, waste and abuse.

That is Speaker Mike Johnson’s (R‑LA) “fiscal responsibility” promise on his website. Yet he is leading Republicans down an irresponsible path with the reconciliation bill moving through the House. The bill would increase federal debt substantially over the coming decade, even beyond the crisis levels in the Congressional Budget Office (CBO) baseline.

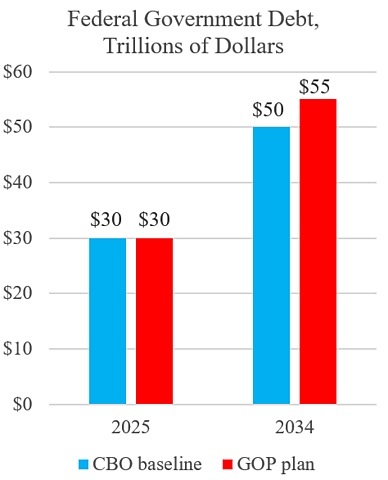

The House plan has a net tax cut of about $6 trillion over 10 years, including interest costs and assuming temporary breaks become permanent. And it has net spending cuts of somewhat more than $1 trillion with interest savings. If that is the final package, federal debt held by the public will soar from $30 trillion this year to about $55 trillion by 2034—$5 trillion more than under the baseline.

In 2023, House Majority Leader Steve Scalise (R‑LA) complained about “President Biden’s runaway spending and America’s debt crisis” [and] “called out the Biden Administration for feeding the national deficit at an unsustainable level by failing to control federal spending.”

In 2022, House Majority Whip Tom Emmer (R‑MN) said, “Our fiscal trajectory as a nation is unsustainable and threatens the future of our children and grandchildren. We can still change course, but we must act now.”

Today, federal debt is already trillions higher than the “crisis” and “unsustainable” levels that Scalise and Emmer worried about.

The Republicans should slow down, add broad-based spending cuts to the reconciliation bill, scrap the proposed new tax loopholes, and tackle federal debt as they have promised. The Big Beautiful Bill should be reworked to tackle the government’s Baleful Bloated Budget.