A key House Republican lawmaker is moving to bring more manufacturing back to the U.S. after President Donald Trump unveiled sweeping tax penalties on imports.

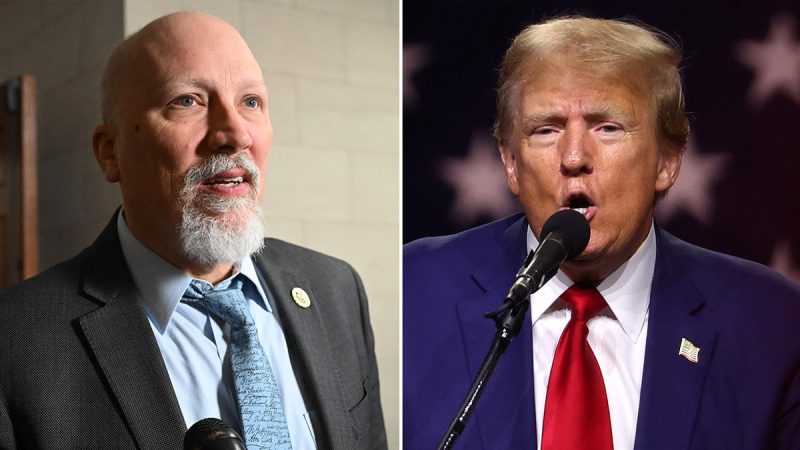

Rep. Chip Roy, R-Texas, policy chair of the House Freedom Caucus, introduced a bill Thursday aimed at providing tax incentives to companies that move their supply chains to the U.S. – so long as their output levels stay consistent in the move.

Roy told Fox News Digital he specifically had China in mind when crafting the legislation.

‘China is angling to surpass the United States as the world’s leading superpower, both politically and economically. If we want to preserve our strength and freedom as a nation, we cannot rely on adversaries like the Chinese Communist Party (CCP) to keep our shelves stocked and our economy prosperous,’ Roy said.

‘There is no time to waste. Congress must act swiftly and collaborate with the Trump administration to revise the tax code to incentivize the reshoring of foreign manufacturing to the United States. The BEAT CHINA Act will do just that, and I look forward to working with House leadership on this important matter.’

Trump’s plan involves a 10% blanket tariff on all imports into the U.S., as well as reciprocal tariffs ranging between 10% and nearly 50% on both adversaries and allies – though in most cases, the U.S. rate is lower than the foreign country’s.

‘April 2, 2025, will forever be remembered as the day American industry was reborn. The day America’s destiny was reclaimed. And the day that we began to make America wealthy again,’ Trump said in remarks announcing his plan Wednesday.

The plan levies a 34% reciprocal tariff against China specifically, compared to the 67% in tariffs that Beijing has slapped on Washington, according to White House data.

Roy’s legislation would affect leases and purchases of commercial space, making companies eligible for bonus depreciation by making non-residential real property purchases by qualifying manufacturers considered 20-year property instead of 39-year property.

It would also allow companies to exclude gains earned from selling off assets in their country of origin from gross taxable income, among other provisions.