Scott Lincicome and Tad DeHaven

President Donald Trump’s decision this week to implement a “permanent” 25 percent tariff on imported automobiles and automotive parts represents one of his most brazen—and foolish—moves yet. For the moment, we’ll leave aside that the president relied on data at least eight years old to ridiculously argue that imported cars threatened national security, that his latest move blows up his own USMCA trade agreement, and that his tariffs can’t both raise substantial revenues (which requires more imports) and boost domestic jobs and investment (which requires fewer imports) as he claims.

Instead, we’ll focus today on just the tariffs’ economics, which—given the reality of global automotive manufacturing and reams of prior analysis—most likely portend higher prices for American consumers, chaos for the US automotive industry, and less domestic production and fewer American automotive jobs in the future.

A Globally Integrated Automotive Industry

To grasp why Trump’s tariffs will cause massive disruptions, consider how integrated the global automotive industry is today, particularly in North America, thanks to decades of open trade (zero tariffs, streamlined procedures, etc.).

Today’s industry is characterized by sophisticated and highly interconnected regional supply chains spanning multiple national borders. In the North American supply chain, the manufacturing of a component like a transmission or engine may require it to travel between the United States, Canada, and Mexico multiple times before finally being incorporated into a finished vehicle.

When tariffs are applied in such an integrated market, costs do not simply rise incrementally—they compound. A single component could therefore be subjected to multiple rounds of tariffs, resulting in exponential increases in the overall cost of manufacturing. In a previous Cato blog post, for example, we showed how a simple car seat capacitor crossed borders five times. According to Canadian manufacturer Linamar, which produces transmissions via factories in the US, Mexico, and Canada, parts cross the three borders seven times, with the transmission finally assembled in Michigan.

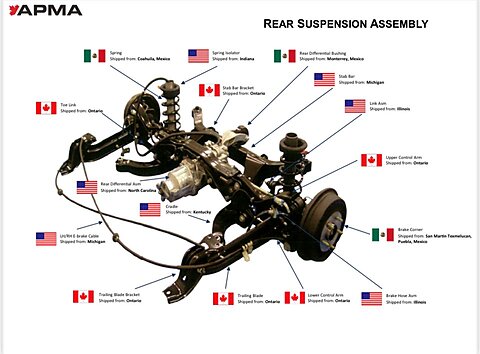

Even if cars and parts don’t cross borders multiple times, the tariff costs for American vehicle manufacturers will be significant because they source significant quantities from abroad. Like a “Made in China” iPhone that contains parts from all over the world, an automobile that’s “Made in America” is assembled with parts from the United States, Canada, Mexico, and elsewhere. Here, for example, is the rear suspension of a vehicle manufactured in North America:

(Source: Flavio Volpe)

As shown in the following charts, this kind of global sourcing is standard practice in today’s automotive industry. Table 1 provides an indicative list of popular US-assembled automobiles that have foreign content shares of anywhere between 30 and 91 percent. (Note that the US and Canada are so interconnected that the government’s data collectors don’t bother to separate the two countries.)

As we see in Figure 1, moreover, imported parts account for more than half of the content in what people would call an “American” vehicle (e.g., Ford and Tesla) made in the USA.

Figure 2 tells a similar story for foreign-nameplate vehicles assembled in the United States.

This does not mean, as TV personality Jim Cramer recently alleged, that US automotive production involves merely the rudimentary assembly of foreign-made engines, transmissions, and other parts. For starters, assembly itself is economically valuable. The BMW plant in Spartanburg, SC, for example, employs more than 11,000 Americans (with junior production roles today starting at $22/hour with benefits), annually produces more than 400,000 vehicles, and was the United States’ top automotive exporter by value ($10 billion) last year.

Domestic automotive manufacturing also entails far more than assembly. In fact, NHTSA data show that the engines/motors in 80 of 143 US-assembled models are made entirely (64) or partly (16) in America, while 82 of those same models have transmissions made here (75 in full; 7 in part).

Collectively, these data reveal the interdependent and complementary nature of US and global automotive production and trade: vehicles and parts are made here; vehicles and parts are made abroad; and both producers and consumers are better off for it.

Imports and Foreign Investment Complement the US Automotive Industry

On the production side, it is widely accepted among automotive industry experts that open trade has been a boon for US manufacturers, and that imports and exports complement domestic sales and production. As shown in Figure 3, for example, automotive imports into the United States have corresponded closely with an overall increase in US automotive production. Contra the (mistaken) White House view of trade deficits, moreover, US deficits in automotive goods have aligned with enhanced domestic output and greater production capacity.

As Lincicome detailed in December, these and other data show why industry insiders and analysts uniformly agree that open markets—not costly Reagan-era protectionism—have fueled the growth and stability of North American automotive production since the 1990s and helped American companies and workers better compete against automotive supply chains in Europe and Asia. By permanently reducing trade barriers, trade agreements like NAFTA have been credited with attracting more foreign investment and boosting overall industry competitiveness by lowering production costs (e.g., via imported inputs), utilizing national comparative advantages, and opening overseas markets. In fact, US automotive manufacturing output and employment were stronger in the 1990s and early 2000s than in the quota-ridden 1980s and stronger than US manufacturing overall during that latter period.

The industry’s need for open markets underscores why economists and industry experts today strongly oppose Trump’s new tariffs and why, as Lincicome documented weeks ago, all automakers producing here expressed similar views during the 2018–19 investigation that underpins them. Even Elon Musk noted this week that Tesla, which has substantial US production, will face a “significant” tariff cost. Burdened with such costs, as well as those from other Trump tariffs (e.g., on steel and aluminum), continued policy uncertainty, and foreign retaliation, it’ll be many US-based automotive manufacturing plants from Michigan to Georgia—and their workers—that suffer.

Impact on American Consumers

Of course, consumers will suffer too from higher automobile prices. As Cato scholars and many others have discussed, tariffs operate as a hidden tax on American consumers—one that they pay directly on imported goods and indirectly via higher-priced domestic alternatives that face less import competition. Given the aforementioned supply chains, moreover, domestic alternatives will face higher-priced parts and equipment, adding further price pressures.

The impact on consumers will be significant. Bryan Riley of the National Taxpayers Union estimates the new tariffs could add an average of $6,500 to the price of vehicles imported from Europe, Japan, and Korea. Vehicles imported from Mexico might see price hikes averaging around $4,500. Anderson Economic Group estimates that the cost increase for cars assembled in North America would range from $4,000 to $12,000 or more. Other estimates show similar pain, which even President Trump himself has recognized, reportedly warning automakers against raising prices in response to his new tariffs.

Tariffs will also limit consumer choices. History shows that manufacturers facing new tariffs often reduce available options or eliminate certain models altogether due to higher costs and potential retaliatory tariffs from trading partners. This helps to explain why, thanks to a longstanding 25 percent US tariff on imported pickup trucks, many smaller truck models aren’t available here. And just today, Reuters reported that industry analysts expect automakers to “spread [tariffs’] cost between US-produced and imported models, cut back on features, and in some cases, stop selling affordable models aimed at first-time car buyers, as many of those are imported and less attractive if they carry a higher price tag.”

As is so often the case with tariffs, the biggest losers will be lower- and middle-income Americans.